Have you ever felt like..

- You have a lot of customers but don’t know where to start?

- Who deserves a special promotion?

- Who’s about to disappear from your radar?

If so… we recommend the RFM Model — a classic tool that still works wonders.

What is RFM?

RFM stands for:

- Recency (R): How recently a customer made a purchase

- Frequency (F): How often they make purchases

- Monetary (M): How much they have spent in total

These three variables are enough to understand customer behavior.

How to Do Simple RFM Segmentation (No Complex Formulas Needed)

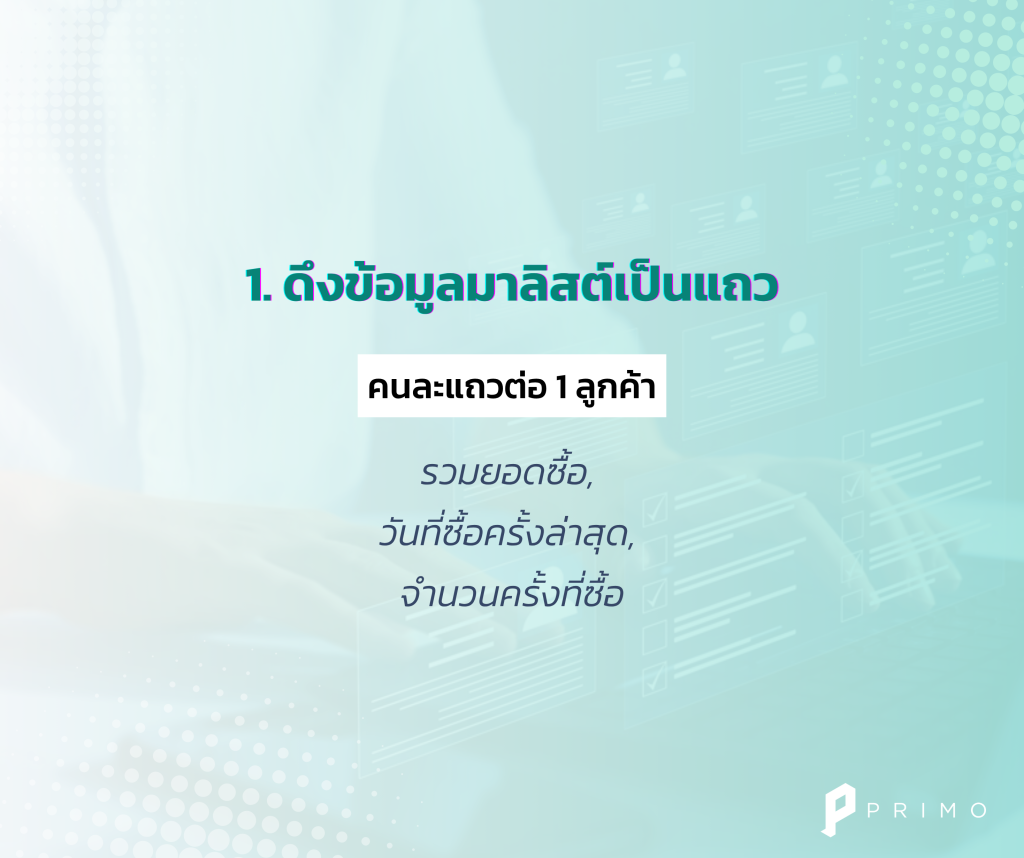

1. Prepare Your Data

- Export your customer list

- Include: last purchase date, number of purchases, total spending

Customer Segmentation and Membership Tiering Learn More

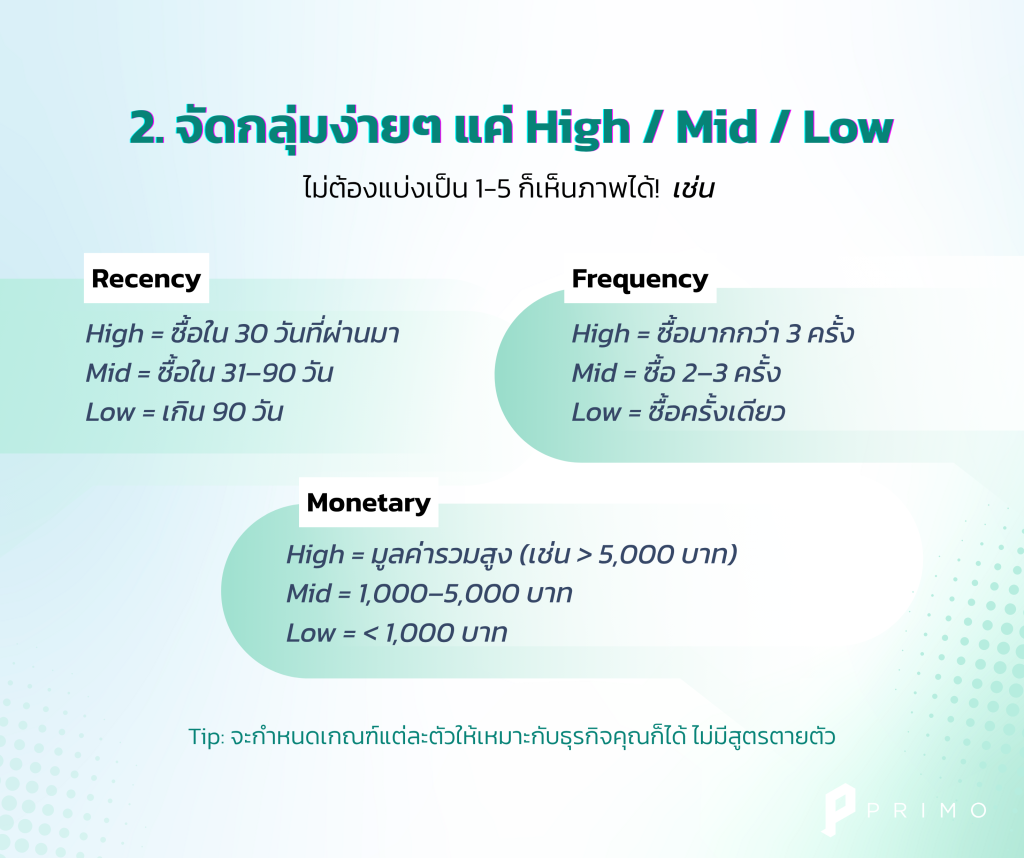

2. Categorize into High / Mid / Low

Example of simple criteria:

Recency (R):

- High = Purchased within the last 30 days

- Mid = 31–90 days

- Low = More than 90 days

Frequency (F):

- High = More than 3 purchases

- Mid = 2–3 purchases

- Low = 1 purchase

Monetary (M):

- High = More than 5,000 THB

- Mid = 1,000–5,000 THB

- Low = Less than 1,000 THB

|

|

Example Segments Based on RFM

| Segment | Description | Recommended Strategy |

|---|---|---|

| R-High / F-High / M-High | VIP Customers | Send exclusive offers, invite to clubs |

| R-Low / F-High | At Risk | Launch a Win-back campaign |

| R-High / F-Low | New Customers | Send onboarding and welcome gifts |

| F-Low / M-Low | Low ROI | Reduce focus or pause campaigns |

SummaryRFM segmentation doesn’t require complicated formulas or scoring systems. Just segment simply and communicate to the right group — that alone can drive results. |