In the modern marketing landscape, a Loyalty CRM for Accounting has become a strategic necessity. While marketing teams focus on engagement, the finance department must manage the "debt" created by every point issued.

Many businesses overlook a critical truth: A Loyalty system not designed for accounting = a financial time bomb. Without proper financial logic, your reward system can lead to massive discrepancies during month-end closing. PRIMO bridges this gap, empowering marketing teams while ensuring the finance department can close books, verify data, and pass audits with absolute confidence.

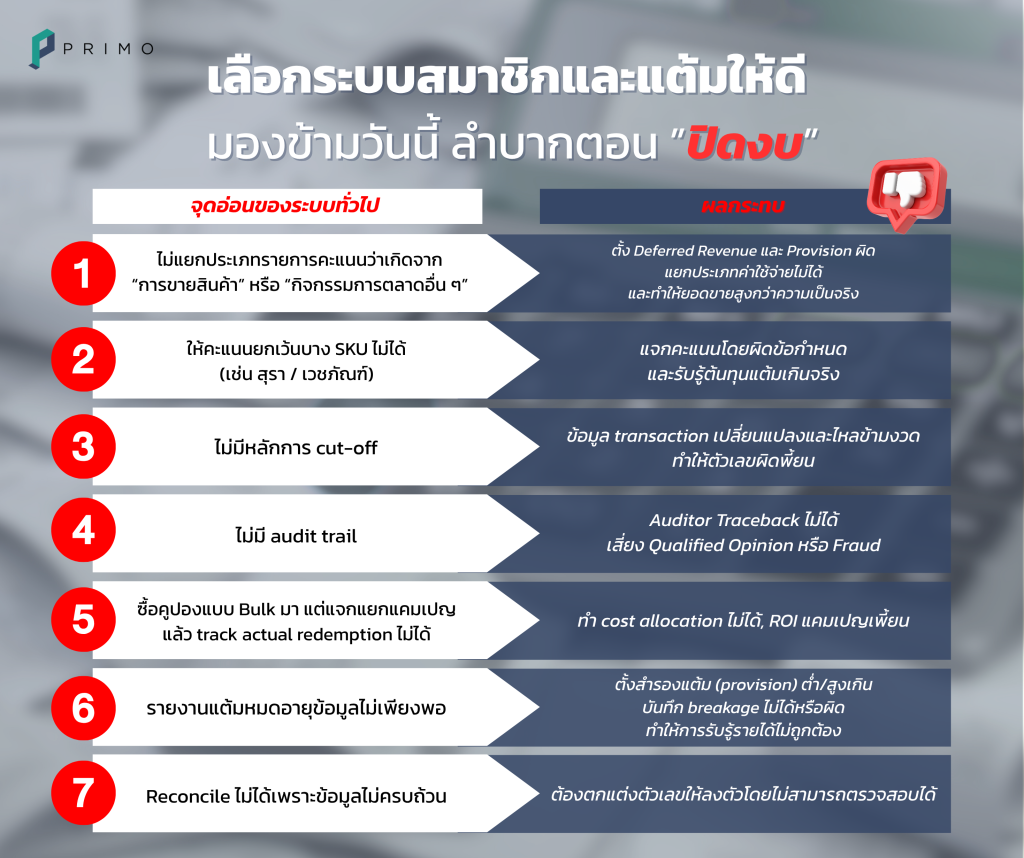

⚠️ 7 Critical Weaknesses: How General Loyalty Systems Become Financial Risks

When a reward point system lacks accounting standards, it creates "financial blind spots" that jeopardize the integrity of your financial statements.

-

Misclassification of Points: Generic systems fail to distinguish between points earned from "Sales" versus "Marketing Activities." This leads to incorrect Deferred Revenue and Provisioning, often resulting in overstated sales figures.

-

Lack of SKU-Level Control: The inability to exclude specific items (e.g., alcohol, tobacco, or pharmaceuticals) leads to regulatory non-compliance and over-recognized point costs.

-

Poor Cut-off Management: Without clear Cut-off principles, transactions often bleed across different accounting periods, distorting the accuracy of your financial reports.

-

Non-existent Audit Trails: If an auditor cannot perform a Traceback, your business faces a high risk of a Qualified Opinion or undetected internal fraud.

-

Blind Coupon Management: Distributing bulk coupons without tracking Actual Redemption per campaign makes it impossible to perform accurate Cost Allocation, rendering your campaign ROI analysis useless.

-

Inadequate Expiry Reporting: Lacking granular data on expiring points leads to miscalculated Provisions and inaccurate Breakage (revenue recognition from expired points).

- Reconciliation Failures: Incomplete data gaps force accounting teams to perform "manual adjustments" to balance the books, which are unverifiable and highly risky during an audit.

Why ERP or POS Loyalty Modules Aren’t Enough

Many companies rely on loyalty modules built into their ERP. However, these are often designed for "Recording" rather than "Management."

-

Limited Marketing Flexibility: ERPs cannot handle complex rules like "Triple points for Gold Tier members on Category A only."

-

Lack of Omnichannel Integration: They aren't built to connect seamlessly with modern front-ends like LINE, Apps, or Websites.

-

The Multi-Brand Barrier: ERP systems often struggle to manage separate brand identities or allocate point liabilities across different business units effectively.

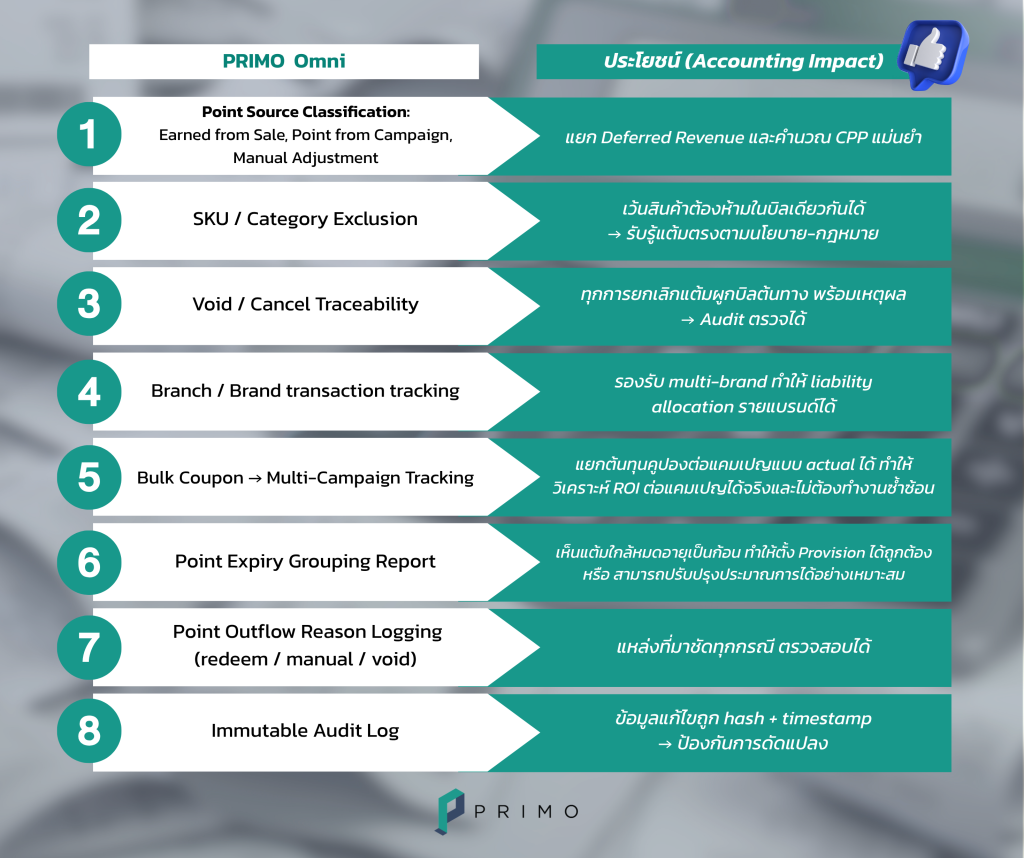

🛡️ PRIMO Omni: A Loyalty CRM Built for Accounting from Day 1

At PRIMO, our philosophy is simple: "If you can award a point, you must be able to account for it." We turn financial liabilities into transparent, verifiable data.

-

Point Source Classification: Categorizes every point (Sale/Campaign/Manual Adjustment) to ensure precise Deferred Revenue and CPP (Cost Per Point) calculations.

-

SKU / Category Exclusion: Automated basket-level controls to ensure compliance with company policies and legal regulations.

-

Void / Cancel Traceability: Every point cancellation is permanently linked to the original bill with a Reason Code, making it effortless for auditors to verify.

-

Branch / Brand Transaction Tracking: Full support for multi-brand environments, ensuring accurate Liability Allocation across various business units.

-

Bulk Coupon & Multi-Campaign Tracking: Tracks the actual cost of every coupon used, allowing for real-time, accurate ROI analysis.

-

Point Expiry Grouping Report: Provides clear visibility into upcoming point expirations, enabling the finance team to adjust Provisions appropriately.

-

Point Outflow Reason Logging: Transparently logs every point exit (Redeem / Manual / Void), ensuring no score goes unaccounted for.

- Immutable Audit Log: All data changes are hashed and timestamped, creating a permanent record that prevents unauthorized data tampering.

Conclusion: Efficient Rewards, Transparent Accounting

Don’t let your loyalty program become a financial liability. A Loyalty CRM that ignores accounting data puts your entire brand at risk. PRIMO ensures that while your marketing team drives growth, your finance team enjoys a stress-free closing process with verifiable, audit-ready data.

Secure your financial future—choose a system built for both marketing and accounting.